From earning $1,600 a month as a firefighter, Jonathan Farrington has built a real estate empire, owning over 30 properties through strategic investments and financial discipline.

Jonathan Farrington’s journey from a firefighter earning just $1,600 a month to a successful real estate investor with a portfolio of over 30 properties is a testament to the power of financial literacy, strategic planning, and disciplined execution. Farrington, now a full-time real estate entrepreneur, leveraged his initial savings and a keen understanding of market dynamics to build his impressive portfolio. His story provides valuable insights and practical advice for anyone looking to break into the real estate market, regardless of their starting point.

Farrington’s initial financial struggles were a major catalyst for change. “I knew I had to do something different if I wanted to create a better future for myself and my family,” Farrington stated. This realization led him to immerse himself in financial education, reading books, attending seminars, and seeking mentorship from experienced investors. He started by meticulously tracking his expenses, identifying areas where he could cut back, and setting clear financial goals. This foundational work allowed him to save a small but significant amount of capital to begin his investment journey.

His first investment was a small, single-family home that he purchased with a combination of savings and a mortgage. He focused on properties that were undervalued or in need of renovation, adding value through improvements and then renting them out. This strategy, known as “BRRRR” (Buy, Rehab, Rent, Refinance, Repeat), became a cornerstone of his investment approach. By refinancing the properties after renovation, he was able to pull out equity and use it to fund the purchase of additional properties.

Farrington’s success wasn’t immediate or without challenges. He faced numerous obstacles, including navigating complex financing options, dealing with tenant issues, and managing property maintenance. However, he persevered by continuously learning, adapting to market changes, and building a strong network of professionals, including real estate agents, contractors, and property managers.

One of the key lessons Farrington emphasizes is the importance of financial literacy. “Understanding the numbers is crucial,” he explains. “You need to be able to analyze deals, understand cash flow, and manage your finances effectively.” He also stresses the importance of having a long-term vision and staying disciplined in the face of market fluctuations. He cautions against get-rich-quick schemes and emphasizes the importance of building a sustainable real estate business through careful planning and execution.

Farrington’s portfolio includes a mix of single-family homes, multi-family properties, and commercial real estate. He strategically diversifies his investments to mitigate risk and maximize returns. He also focuses on building a positive relationship with his tenants, viewing them as partners in his business. “Happy tenants are long-term tenants,” he notes, “and that’s essential for generating consistent cash flow.”

His journey also involved significant lifestyle adjustments. Leaving the stability of a firefighting career to pursue entrepreneurship was a calculated risk. He and his family made sacrifices to free up capital for investments, demonstrating the commitment needed for such a transition.

Farrington’s story is not just about financial success; it’s also about personal growth and the desire to create a better life. He now dedicates his time to mentoring aspiring real estate investors, sharing his knowledge and experience to help others achieve their financial goals. He regularly conducts workshops, webinars, and coaching sessions, providing practical advice and guidance to individuals looking to break into the real estate market.

He advocates for continuous learning, emphasizing the need to stay updated on market trends, legal regulations, and best practices in property management. He also encourages aspiring investors to seek out mentors who can provide guidance and support. “Having someone who has been there and done that can be invaluable,” he says.

Farrington’s real estate empire continues to grow, but he remains grounded and focused on his mission of helping others achieve financial freedom through real estate investing. He actively shares his insights and strategies through social media, online courses, and public speaking engagements. He is a firm believer that anyone can achieve financial success with the right mindset, knowledge, and dedication.

His approach emphasizes the importance of building a strong foundation, starting small, and scaling gradually. He encourages aspiring investors to focus on generating positive cash flow, managing risk, and building long-term wealth. He also stresses the importance of ethical and responsible investing, ensuring that properties are well-maintained and tenants are treated fairly.

Farrington’s success story serves as an inspiration to aspiring real estate investors around the world. It demonstrates that with hard work, determination, and a commitment to financial literacy, it is possible to achieve financial freedom and build a thriving real estate business. His journey from firefighter to real estate king is a testament to the power of perseverance and the transformative potential of real estate investing.

Detailed Breakdown of Farrington’s Strategies

Farrington’s success isn’t just about luck; it’s rooted in a series of well-defined strategies that he meticulously implemented over time. These strategies offer actionable insights for anyone looking to replicate his success in the real estate market.

- Financial Literacy as the Foundation: Farrington’s journey began with a commitment to financial literacy. Recognizing his initial lack of knowledge, he dedicated time to learning about personal finance, investing, and real estate. He read books, attended seminars, and sought out mentors who could guide him. This foundational knowledge provided him with the tools and understanding necessary to make informed investment decisions.

- “I knew I had to do something different if I wanted to create a better future for myself and my family,” Farrington noted, emphasizing the importance of recognizing the need for change and taking proactive steps to acquire the necessary knowledge.

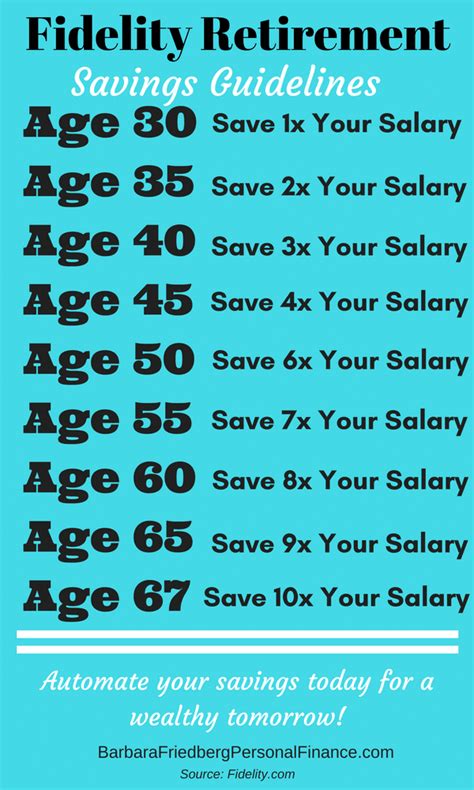

- Strategic Budgeting and Saving: Before making any investments, Farrington focused on optimizing his personal finances. He meticulously tracked his expenses, identified areas where he could cut back, and created a budget that allowed him to save a portion of his income. This disciplined approach provided him with the initial capital needed to start investing.

- He recommends using budgeting tools and apps to track expenses and identify areas for improvement. He also suggests automating savings to ensure that a portion of each paycheck is automatically set aside for investment purposes.

- The BRRRR Strategy: The “BRRRR” (Buy, Rehab, Rent, Refinance, Repeat) strategy became a cornerstone of Farrington’s investment approach. This strategy involves purchasing undervalued properties that require renovation, adding value through improvements, renting them out to generate income, refinancing the properties to pull out equity, and then repeating the process with the equity gained.

- This strategy allows investors to leverage their initial capital to acquire multiple properties over time. By adding value through renovations, investors can increase the property’s value and rental income, leading to higher returns.

- Due Diligence and Market Analysis: Farrington emphasizes the importance of conducting thorough due diligence before investing in any property. This includes researching the local market, analyzing comparable sales, and assessing the property’s condition. He also stresses the importance of understanding the legal and regulatory requirements related to real estate investing.

- He recommends working with experienced real estate agents, inspectors, and attorneys to ensure that all aspects of the transaction are properly vetted. He also suggests using online resources and tools to research market trends and property values.

- Building a Strong Network: Farrington recognizes the importance of building a strong network of professionals, including real estate agents, contractors, property managers, and lenders. These relationships provide access to valuable information, resources, and support.

- He recommends attending industry events, joining real estate associations, and networking with other investors. He also suggests building relationships with local contractors and property managers to ensure that properties are properly maintained and managed.

- Tenant Relations and Property Management: Farrington places a strong emphasis on building positive relationships with his tenants. He believes that happy tenants are long-term tenants, which is essential for generating consistent cash flow. He also stresses the importance of providing timely and responsive property management services.

- He recommends conducting thorough tenant screenings, providing clear and concise lease agreements, and responding promptly to tenant requests and concerns. He also suggests using property management software to streamline the process of managing properties and tenants.

- Long-Term Vision and Patience: Farrington’s success is a result of his long-term vision and his ability to stay patient and disciplined in the face of market fluctuations. He cautions against get-rich-quick schemes and emphasizes the importance of building a sustainable real estate business through careful planning and execution.

- He recommends setting clear financial goals, creating a detailed investment plan, and regularly reviewing and adjusting the plan as needed. He also suggests staying informed about market trends and economic conditions to make informed investment decisions.

- Continuous Learning and Adaptation: The real estate market is constantly evolving, so Farrington emphasizes the importance of continuous learning and adaptation. He stays updated on market trends, legal regulations, and best practices in property management. He also seeks out new opportunities and strategies to improve his investment performance.

- He recommends attending industry conferences, reading real estate publications, and taking online courses to stay informed about the latest trends and strategies. He also suggests being open to new ideas and adapting to changing market conditions.

- Risk Management and Diversification: Farrington strategically diversifies his investments to mitigate risk and maximize returns. He invests in a mix of single-family homes, multi-family properties, and commercial real estate. He also focuses on generating positive cash flow and maintaining a healthy debt-to-equity ratio.

- He recommends conducting thorough risk assessments before investing in any property and diversifying investments across different asset classes and geographic locations. He also suggests maintaining a cash reserve to cover unexpected expenses and market downturns.

The Role of Mentorship and Education

A significant aspect of Farrington’s journey is his emphasis on mentorship and ongoing education. He actively sought guidance from experienced real estate investors and dedicated himself to learning the intricacies of the market. This proactive approach allowed him to avoid costly mistakes and accelerate his learning curve.

- Seeking Mentorship: Farrington recognized the value of learning from others who had already achieved success in real estate. He sought out mentors who could provide guidance, advice, and support. These mentors helped him navigate the complexities of the market, avoid common pitfalls, and make informed investment decisions.

- He recommends identifying potential mentors who have experience in the areas of real estate that you are interested in. He also suggests being proactive in seeking out mentorship opportunities and building strong relationships with mentors.

- Investing in Education: Farrington invested in his own education by reading books, attending seminars, and taking online courses. This allowed him to gain a deeper understanding of real estate investing principles, strategies, and best practices.

- He recommends creating a learning plan that includes specific goals, timelines, and resources. He also suggests tracking your progress and celebrating your achievements along the way.

Impact of Lifestyle Adjustments and Sacrifices

Farrington’s transition from a firefighter to a real estate entrepreneur required significant lifestyle adjustments and sacrifices. He and his family made conscious decisions to prioritize their financial goals and free up capital for investments.

- Reducing Expenses: Farrington and his family made a conscious effort to reduce their expenses and live more frugally. This allowed them to save more money for investments.

- He recommends tracking your expenses, identifying areas where you can cut back, and creating a budget that aligns with your financial goals. He also suggests automating your savings to ensure that you are consistently saving money for investments.

- Working Extra Hours: Farrington worked extra hours as a firefighter to earn additional income that he could use to fund his investments.

- He recommends exploring opportunities to increase your income, such as taking on a side hustle or freelancing. He also suggests using any extra income to pay down debt or invest in assets that will generate passive income.

- Delaying Gratification: Farrington and his family delayed gratification by foregoing non-essential purchases and experiences. This allowed them to focus on their long-term financial goals.

- He recommends setting clear financial goals and creating a plan to achieve them. He also suggests being mindful of your spending habits and avoiding impulse purchases.

The Importance of Ethical and Responsible Investing

Farrington emphasizes the importance of ethical and responsible investing. He believes that real estate investors have a responsibility to treat their tenants fairly, maintain their properties to a high standard, and contribute to the communities in which they invest.

- Tenant Relations: Farrington places a strong emphasis on building positive relationships with his tenants. He believes that happy tenants are long-term tenants, which is essential for generating consistent cash flow.

- He recommends conducting thorough tenant screenings, providing clear and concise lease agreements, and responding promptly to tenant requests and concerns.

- Property Maintenance: Farrington maintains his properties to a high standard to ensure that they are safe, comfortable, and attractive to tenants.

- He recommends conducting regular property inspections, addressing maintenance issues promptly, and making necessary repairs and improvements.

- Community Involvement: Farrington believes that real estate investors have a responsibility to contribute to the communities in which they invest.

- He recommends supporting local businesses, volunteering in community organizations, and advocating for policies that promote economic development and affordable housing.

Farrington’s story is a powerful reminder that with hard work, dedication, and a commitment to financial literacy, anyone can achieve financial freedom through real estate investing. His journey from firefighter to real estate king is a testament to the transformative potential of perseverance and the importance of giving back to the community.

Frequently Asked Questions (FAQ)

-

How did Jonathan Farrington manage to acquire over 30 properties starting from a $1,600 monthly income?

Farrington achieved this through a combination of rigorous financial discipline, strategic budgeting, continuous financial education, and the BRRRR (Buy, Rehab, Rent, Refinance, Repeat) method. He started by meticulously tracking expenses and saving diligently. He then invested in undervalued properties, renovated them to increase their value, rented them out for cash flow, and refinanced to pull out equity for subsequent purchases. He said, “I knew I had to do something different if I wanted to create a better future for myself and my family,” indicating his motivation for change.

-

What is the BRRRR method, and how did Farrington use it to build his real estate portfolio?

The BRRRR method is a real estate investment strategy involving buying distressed properties, rehabilitating them to increase their value, renting them out to generate income, refinancing the property to extract equity, and then repeating the process with the extracted capital to purchase more properties. Farrington used this method to scale his portfolio by leveraging the increased value and rental income to secure financing for additional investments.

-

What challenges did Farrington face in his journey from firefighter to real estate entrepreneur, and how did he overcome them?

Farrington faced challenges such as navigating complex financing options, managing tenant issues, and handling property maintenance. He overcame these challenges by continuously learning, adapting to market changes, and building a strong network of professionals, including real estate agents, contractors, and property managers. He emphasized, “Understanding the numbers is crucial,” highlighting the importance of financial literacy in overcoming obstacles.

-

What advice does Farrington give to aspiring real estate investors who are just starting out?

Farrington advises aspiring investors to prioritize financial literacy, start small, focus on generating positive cash flow, and build a strong network of professionals. He also emphasizes the importance of having a long-term vision, staying disciplined, and being prepared for challenges. He suggests seeking mentors and continuously learning to stay updated on market trends and best practices.

-

How did Farrington balance his firefighting career with his real estate ventures, and what sacrifices did he make to achieve his goals?

Farrington balanced his firefighting career with real estate ventures by working extra hours, meticulously planning his investments, and making strategic lifestyle adjustments. He and his family made sacrifices to free up capital for investments, demonstrating the commitment needed for such a transition. This involved reducing expenses, delaying gratification, and dedicating significant time to managing his properties and expanding his knowledge of the real estate market.