Are you saving enough for retirement? Benchmarks vary widely depending on age, but experts suggest having approximately one year’s salary saved by age 30, three times your salary by 40, and ten times your salary by retirement age. However, these are just guidelines, and individual circumstances play a significant role.

Many Americans find themselves behind these targets, facing the daunting reality of needing to catch up. Financial advisors stress the importance of starting early and consistently contributing to retirement accounts to harness the power of compounding. This article delves into the savings benchmarks for different age groups, the factors influencing individual retirement needs, and strategies for improving your retirement savings trajectory.

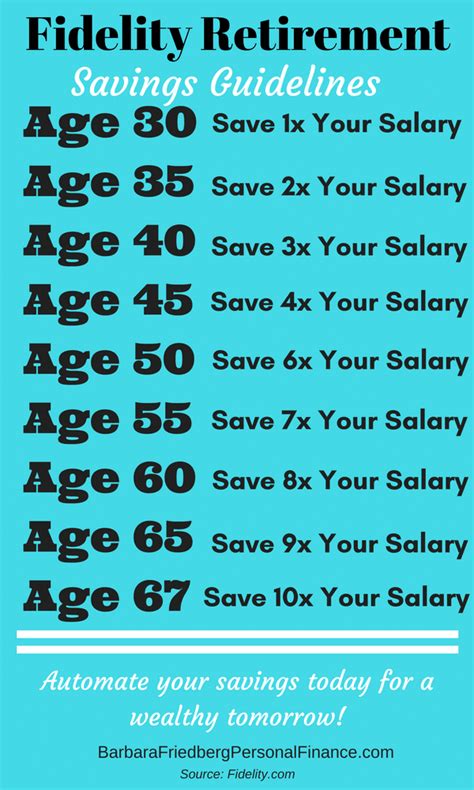

Savings Benchmarks by Age: Are You on Track?

Retirement planning is a highly individualized process, but some general guidelines can help gauge your progress. Fidelity Investments, for instance, recommends having at least one times your current salary saved by age 30, three times your salary by age 40, six times your salary by age 50, and eight times your salary by age 60. By retirement, ideally, you should aim for ten times your final salary.

These benchmarks are designed to provide a reasonable level of retirement income, assuming you plan to withdraw approximately 4% of your savings each year. However, these are not rigid rules, and your personal circumstances may require a different savings rate.

Factors Influencing Retirement Savings Needs

Several factors influence how much you need to save for retirement:

- Desired Retirement Lifestyle: A lavish retirement lifestyle with frequent travel and expensive hobbies requires significantly more savings than a more modest lifestyle.

- Expected Retirement Age: Retiring earlier means you will need more savings to cover a longer retirement period.

- Healthcare Costs: Healthcare expenses tend to increase with age, making it crucial to factor them into your retirement planning.

- Inflation: The rising cost of goods and services erodes the purchasing power of your savings, so it’s essential to account for inflation.

- Investment Returns: The performance of your investments plays a crucial role in the growth of your retirement savings.

- Social Security Benefits: Social Security can provide a portion of your retirement income, but it may not be enough to cover all your expenses.

- Pension Income: If you have a pension, it can supplement your retirement savings.

“There’s no magic number because everyone’s situation is unique,” says a financial advisor at a large firm. “The key is to understand your own needs and plan accordingly.”

What to Do If You’re Behind on Savings

If you find yourself behind the recommended savings benchmarks, don’t panic. Several strategies can help you catch up:

- Increase Contributions: The most straightforward way to boost your retirement savings is to increase your contributions to your 401(k), IRA, or other retirement accounts. Even a small increase can make a big difference over time.

- Take Advantage of Employer Matching: If your employer offers a 401(k) match, make sure you contribute enough to take full advantage of it. This is essentially free money.

- Reduce Expenses: Cutting back on unnecessary expenses can free up more money for retirement savings.

- Delay Retirement: Working a few extra years can significantly boost your retirement savings and reduce the length of your retirement period.

- Consider a Roth IRA: Roth IRAs offer tax-free withdrawals in retirement, which can be a significant advantage.

- Seek Professional Advice: A financial advisor can help you create a personalized retirement plan and provide guidance on investment strategies.

The Power of Compounding

Compounding is the process of earning returns on your initial investment and the accumulated interest. The earlier you start saving, the more time your money has to grow through compounding.

For example, if you invest $10,000 at age 25 and earn an average annual return of 7%, your investment could grow to over $76,000 by age 65. If you wait until age 35 to invest the same amount, your investment would only grow to around $38,700 by age 65. This highlights the importance of starting early.

Understanding Different Retirement Savings Options

Several retirement savings options are available, each with its own advantages and disadvantages:

- 401(k): A 401(k) is a retirement savings plan sponsored by your employer. Contributions are typically made on a pre-tax basis, and your earnings grow tax-deferred.

- IRA (Individual Retirement Account): An IRA is a retirement savings account that you can open on your own. There are two main types of IRAs: traditional and Roth. Traditional IRAs offer tax-deductible contributions, while Roth IRAs offer tax-free withdrawals in retirement.

- Roth IRA: Contributions are made after-tax, but qualified withdrawals in retirement, including earnings, are tax-free. This can be advantageous if you expect to be in a higher tax bracket in retirement.

- Traditional IRA: Contributions may be tax-deductible, depending on your income and filing status. Earnings grow tax-deferred, and withdrawals are taxed in retirement.

- SEP IRA (Simplified Employee Pension Plan): A SEP IRA is a retirement plan for self-employed individuals and small business owners. Contributions are tax-deductible, and earnings grow tax-deferred.

- SIMPLE IRA (Savings Incentive Match Plan for Employees): A SIMPLE IRA is a retirement plan for small businesses with fewer than 100 employees. Contributions can be made by both the employer and the employee.

- Annuities: An annuity is a contract with an insurance company that guarantees a stream of income in retirement. Annuities can be either fixed or variable.

- Taxable Investment Accounts: While not specifically designed for retirement, taxable investment accounts can be used to save for retirement. However, investment earnings are subject to taxes each year.

Choosing the right retirement savings option depends on your individual circumstances and financial goals.

The Role of Social Security

Social Security is a government-funded program that provides retirement, disability, and survivor benefits. Most workers are eligible for Social Security benefits after working for a certain number of years and paying Social Security taxes.

The amount of your Social Security benefit depends on your earnings history and the age at which you begin receiving benefits. You can start receiving benefits as early as age 62, but your benefit will be reduced. If you wait until your full retirement age (which is currently 67 for those born in 1960 or later), you will receive your full benefit. If you delay claiming benefits until age 70, you will receive an even larger benefit.

Social Security can provide a significant portion of your retirement income, but it’s important to remember that it’s not designed to be your sole source of income. It’s essential to supplement your Social Security benefits with savings from other retirement accounts.

Common Retirement Planning Mistakes to Avoid

- Starting Too Late: As mentioned earlier, the earlier you start saving, the more time your money has to grow through compounding.

- Not Saving Enough: It’s essential to save enough to cover your expenses in retirement.

- Investing Too Conservatively: While it’s important to manage risk, investing too conservatively can limit your potential returns.

- Withdrawing Too Early: Withdrawing from your retirement accounts before retirement can result in penalties and reduce your savings.

- Ignoring Inflation: Inflation erodes the purchasing power of your savings, so it’s essential to factor it into your retirement planning.

- Failing to Plan for Healthcare Costs: Healthcare expenses tend to increase with age, making it crucial to factor them into your retirement planning.

- Not Seeking Professional Advice: A financial advisor can provide valuable guidance on retirement planning.

The Impact of Economic Conditions

Economic conditions can significantly impact your retirement savings. Recessions, market downturns, and inflation can all negatively affect your portfolio.

It’s important to have a diversified investment portfolio to help mitigate the impact of market volatility. Diversification involves spreading your investments across different asset classes, such as stocks, bonds, and real estate.

It’s also important to stay calm and avoid making rash decisions during market downturns. Selling your investments during a downturn can lock in losses and prevent you from participating in the subsequent recovery.

Retirement Planning for Women

Women often face unique challenges when it comes to retirement planning. They tend to live longer than men, which means they need to save more to cover a longer retirement period. They also tend to earn less than men, which can make it more difficult to save for retirement. Additionally, women are more likely to take time off from work to care for children or other family members, which can impact their earnings and retirement savings.

Women can take several steps to improve their retirement outlook:

- Start Saving Early: The earlier you start saving, the more time your money has to grow.

- Contribute Regularly: Even small, consistent contributions can make a big difference over time.

- Invest Wisely: Choose investments that are appropriate for your risk tolerance and time horizon.

- Take Advantage of Employer Matching: If your employer offers a 401(k) match, make sure you contribute enough to take full advantage of it.

- Seek Professional Advice: A financial advisor can help you create a personalized retirement plan.

Retirement Planning for Self-Employed Individuals

Self-employed individuals face unique challenges when it comes to retirement planning because they don’t have access to employer-sponsored retirement plans like 401(k)s. However, several retirement savings options are available to self-employed individuals, such as SEP IRAs, SIMPLE IRAs, and solo 401(k)s.

Self-employed individuals should also consider the following:

- Estimate Your Income Accurately: It’s important to have a clear understanding of your income to determine how much you can afford to save for retirement.

- Be Disciplined: It can be tempting to put off saving for retirement when you’re self-employed, but it’s important to be disciplined and save consistently.

- Consider Tax Implications: Different retirement savings options have different tax implications, so it’s important to choose the option that is most advantageous for your situation.

- Seek Professional Advice: A financial advisor can help you navigate the complexities of retirement planning for self-employed individuals.

Staying on Track: Regular Reviews and Adjustments

Retirement planning is not a one-time event; it’s an ongoing process. It’s important to review your retirement plan regularly and make adjustments as needed.

You should review your retirement plan at least once a year, or more frequently if there have been significant changes in your life, such as a job change, a marriage, or the birth of a child.

When reviewing your retirement plan, consider the following:

- Are you on track to meet your retirement goals?

- Are your investments performing as expected?

- Have your expenses changed?

- Have there been any changes in your tax situation?

- Do you need to make any adjustments to your savings rate or investment strategy?

By regularly reviewing and adjusting your retirement plan, you can stay on track to achieve your financial goals and enjoy a comfortable retirement.

The Psychological Aspect of Retirement Planning

Retirement planning isn’t just about numbers; it also involves a psychological component. Many people find it difficult to think about retirement because it seems so far away. Others may be afraid to face the reality of their financial situation.

It’s important to address these psychological barriers to retirement planning. Here are some tips:

- Start Small: You don’t have to solve all your retirement planning problems overnight. Start by taking small steps, such as setting up a retirement account or increasing your contributions.

- Focus on the Positive: Instead of dwelling on the challenges of retirement planning, focus on the benefits of having a secure financial future.

- Seek Support: Talk to friends, family members, or a financial advisor about your retirement planning concerns.

- Visualize Your Retirement: Imagine what you want your retirement to look like. This can help you stay motivated to save and plan.

By addressing the psychological aspect of retirement planning, you can overcome your fears and anxieties and take control of your financial future.

Beyond Savings: Alternative Income Streams in Retirement

While savings are crucial, exploring alternative income streams can significantly enhance your retirement security. These options provide flexibility and can buffer against unexpected expenses or market volatility.

- Part-Time Work: Many retirees choose to work part-time to supplement their income and stay active. This can range from consulting in their previous field to pursuing a passion project. The income generated can cover living expenses or allow for more discretionary spending.

- Rental Income: If you own a property, renting it out can provide a steady stream of income. This requires careful management and consideration of tenant laws, but can be a valuable asset.

- Royalties and Intellectual Property: If you have creative skills, consider generating income through royalties from books, music, or other intellectual property.

- Online Businesses: The internet offers numerous opportunities for generating income in retirement, such as blogging, freelancing, or selling products online.

- Reverse Mortgages: A reverse mortgage allows homeowners aged 62 and older to borrow against the equity in their homes. However, it’s crucial to understand the terms and potential risks involved before considering this option.

- Investing in Dividend-Paying Stocks: Dividends are payments made by companies to their shareholders. Investing in dividend-paying stocks can provide a regular stream of income in retirement.

- Peer-to-Peer Lending: Peer-to-peer lending involves lending money to individuals or businesses through online platforms. This can offer higher returns than traditional savings accounts, but also carries a higher level of risk.

The Importance of Estate Planning

Retirement planning goes hand-in-hand with estate planning. Estate planning involves making arrangements for the management and distribution of your assets after your death.

A comprehensive estate plan should include the following:

- Will: A will is a legal document that specifies how you want your assets to be distributed after your death.

- Trust: A trust is a legal arrangement that allows you to transfer assets to a trustee, who manages them for the benefit of your beneficiaries.

- Power of Attorney: A power of attorney is a legal document that authorizes someone to act on your behalf if you become incapacitated.

- Healthcare Directive: A healthcare directive, also known as a living will, is a legal document that specifies your wishes regarding medical treatment if you are unable to make decisions for yourself.

- Beneficiary Designations: It’s important to keep your beneficiary designations up-to-date on all your retirement accounts and insurance policies.

Estate planning can help ensure that your assets are distributed according to your wishes and that your loved ones are taken care of after your death. Consulting with an estate planning attorney is highly recommended.

The Future of Retirement

The concept of retirement is evolving. With increasing life expectancies and changing economic conditions, many people are choosing to work longer, pursue new careers, or engage in volunteer activities during their retirement years.

The traditional model of retirement, where people stop working completely at a certain age, is becoming less common. Instead, many people are opting for a phased retirement, where they gradually reduce their work hours over time.

The future of retirement is likely to be more flexible and individualized, with people tailoring their retirement plans to their own unique needs and circumstances.

Frequently Asked Questions (FAQ)

-

How much should I have saved for retirement by age 30?

Generally, experts recommend having approximately one year’s salary saved by age 30. For instance, if your annual salary is $60,000, you should aim to have around $60,000 in retirement savings. However, this is just a guideline, and individual circumstances may vary.

-

What if I’m behind on my retirement savings?

Don’t panic. Several strategies can help you catch up, including increasing contributions, taking advantage of employer matching, reducing expenses, delaying retirement, considering a Roth IRA, and seeking professional financial advice. Even small adjustments can make a significant difference over time.

-

What are the different types of retirement accounts available?

Common retirement accounts include 401(k)s, offered through employers; Traditional and Roth IRAs, which individuals can open; SEP IRAs and SIMPLE IRAs, designed for self-employed individuals and small business owners; and taxable investment accounts. Each has different tax advantages and eligibility requirements.

-

How does Social Security fit into my retirement plan?

Social Security can provide a portion of your retirement income, but it’s typically not enough to cover all expenses. The amount you receive depends on your earnings history and the age at which you begin receiving benefits. It’s essential to supplement Social Security with savings from other retirement accounts.

-

Is it better to invest in a Roth IRA or a Traditional IRA?

The best choice depends on your individual circumstances and expectations about future tax rates. Roth IRAs offer tax-free withdrawals in retirement, which can be advantageous if you expect to be in a higher tax bracket. Traditional IRAs offer tax-deductible contributions, which can be beneficial if you are in a higher tax bracket now. Consider your current and future income, tax bracket, and investment goals when making this decision.

By understanding these factors and taking proactive steps, you can improve your retirement outlook and secure a comfortable financial future. Remember that retirement planning is a marathon, not a sprint, and it’s never too late to start.