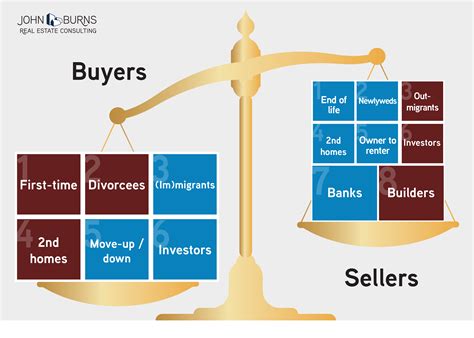

Housing market dynamics are shifting dramatically as a surge in sellers coincides with a pullback from buyers, creating a significant imbalance and potential turbulence in the real estate sector. Inventory is swelling, forcing sellers to confront longer listing times and potential price cuts, while buyers are hesitant amidst affordability concerns and high mortgage rates.

The U.S. housing market is experiencing a stark divergence between supply and demand, with a flood of new listings outpacing buyer interest, according to recent data. This growing imbalance is raising concerns about potential price corrections and increased challenges for sellers. The surge in inventory is driven by various factors, including homeowners looking to capitalize on previous gains and those eager to relocate amidst changing economic conditions. However, rising mortgage rates and persistent affordability challenges are deterring potential buyers, leading to a slowdown in sales and an accumulation of unsold homes.

“Sellers are flooding the home market while buyers have seemingly disappeared,” stated the original Yahoo Finance report, highlighting the severity of the current situation. This dynamic is creating a challenging environment for sellers who are now facing increased competition and longer periods on the market before securing a sale. The shift marks a significant departure from the frenzied market conditions of the past two years, when demand far outstripped supply, leading to bidding wars and rapid price appreciation.

Inventory levels are climbing steadily across the country, with some markets experiencing particularly sharp increases. This rise in available homes is giving buyers more options and negotiating power, a stark contrast to the limited choices and intense competition that characterized the pandemic-era market. As inventory grows, sellers are increasingly finding themselves needing to adjust their pricing expectations to attract potential buyers. Price reductions are becoming more common, signaling a potential cooling of the market after years of rapid growth.

The primary driver behind the buyer pullback is the significant increase in mortgage rates. As the Federal Reserve has aggressively raised interest rates to combat inflation, mortgage rates have followed suit, pushing the cost of homeownership beyond the reach of many prospective buyers. Higher rates not only reduce affordability but also decrease buyer confidence, leading to a more cautious approach to the market. Many potential buyers are now opting to wait on the sidelines, hoping that rates will eventually decline or that home prices will adjust to more affordable levels.

Another factor contributing to the slowdown in buyer demand is the ongoing uncertainty surrounding the economy. Concerns about a potential recession, job losses, and inflation are weighing on consumer sentiment and making potential buyers hesitant to make large financial commitments. This economic uncertainty is further compounded by high housing prices, creating a perfect storm of affordability challenges that are keeping many buyers out of the market.

The impact of this imbalance is not uniform across all regions. Some markets are experiencing more pronounced slowdowns than others, depending on factors such as local economic conditions, population growth, and housing supply. Areas with high housing costs and limited job growth are particularly vulnerable to the effects of the buyer pullback. Conversely, markets with strong economies and growing populations may be more resilient to the downturn.

For sellers, the changing market dynamics require a new approach. Gone are the days of simply listing a home and receiving multiple offers within days. Sellers now need to be more strategic in their pricing, marketing, and presentation of their properties. This includes conducting thorough market research to determine a competitive listing price, investing in professional staging and photography to showcase the home’s best features, and being prepared to negotiate with potential buyers.

Real estate agents are also adapting to the changing market conditions. They are now advising their clients to be more patient and realistic about their expectations. Agents are also playing a more active role in helping sellers understand the current market dynamics and develop effective strategies for attracting buyers. This includes providing data-driven insights, offering advice on pricing and staging, and negotiating on behalf of their clients.

The imbalance between supply and demand is expected to persist for the foreseeable future, as long as mortgage rates remain elevated and economic uncertainty continues. However, some analysts believe that the market will eventually stabilize as buyers and sellers adjust to the new normal. This could involve a period of price corrections, followed by a gradual recovery in sales activity.

The current market conditions present both challenges and opportunities for different players in the real estate sector. Sellers need to be prepared to adapt their strategies to meet the changing market demands. Buyers, on the other hand, may find more opportunities to negotiate and find homes that fit their needs and budgets. Real estate agents need to be proactive in providing guidance and support to their clients as they navigate the evolving landscape.

The long-term implications of the housing market imbalance are still uncertain. However, it is clear that the market is undergoing a significant transformation that will reshape the way homes are bought and sold. As the market continues to evolve, it is essential for all stakeholders to stay informed and adapt to the changing conditions.

Detailed Analysis:

The shift in the housing market, as reflected in the growing inventory and dwindling buyer interest, is multifaceted. The surge in sellers can be attributed to several converging factors. Firstly, many homeowners who had been contemplating selling for some time are now motivated to list their properties. The unprecedented price appreciation witnessed during the pandemic created a window of opportunity for sellers to realize substantial gains on their investments. This incentive, coupled with the anticipation of potential market corrections, has prompted many to enter the market.

Secondly, changing lifestyle preferences and remote work arrangements are also contributing to the increased supply of homes. As more companies adopt flexible work policies, some homeowners are seeking to relocate to different areas or downsize their living spaces. This trend has led to a greater number of homes being put up for sale in certain regions, further exacerbating the inventory imbalance.

However, the influx of sellers is meeting a wall of buyer hesitancy. Rising mortgage rates are the primary culprit, significantly impacting affordability and dampening demand. The Federal Reserve’s efforts to curb inflation have led to a sharp increase in borrowing costs, making it more expensive for potential buyers to finance home purchases. This has effectively priced many buyers out of the market, particularly first-time homebuyers who are more sensitive to interest rate fluctuations.

The impact of rising mortgage rates is further compounded by persistent affordability challenges. Even before the recent surge in rates, housing prices had already reached historically high levels in many markets, making it difficult for buyers to save for a down payment and qualify for a mortgage. The combination of high prices and rising rates has created a double whammy for buyers, making homeownership increasingly unattainable.

Economic uncertainty is also playing a significant role in the buyer pullback. Concerns about a potential recession, job losses, and inflation are weighing on consumer sentiment and making potential buyers more cautious about making large financial commitments. The fear of an economic downturn is leading some buyers to delay their purchases, waiting for more clarity and stability in the market.

The regional variations in the housing market are also noteworthy. While some areas are experiencing a more pronounced slowdown than others, certain markets remain relatively resilient. Factors such as local economic conditions, population growth, and housing supply are influencing the performance of different regions. Areas with strong economies, growing populations, and limited housing supply are likely to fare better than those with weaker economies, declining populations, and ample housing inventory.

The increased inventory is giving buyers more negotiating power, a stark contrast to the bidding wars that characterized the pandemic-era market. With more homes available to choose from, buyers are no longer pressured to make quick decisions or overpay for properties. They can now take their time to evaluate their options, negotiate for better terms, and even request repairs or concessions from sellers.

For sellers, the changing market dynamics require a shift in strategy. Pricing is now more critical than ever. Sellers need to be realistic about the value of their homes and price them competitively to attract buyers. Overpricing a property can lead to longer listing times, price reductions, and ultimately a lower sale price.

Marketing and presentation are also essential for success in the current market. Sellers need to showcase their homes in the best possible light, highlighting their unique features and benefits. This includes investing in professional staging and photography, creating compelling marketing materials, and hosting open houses and showings to attract potential buyers.

Negotiation skills are also becoming increasingly important. Sellers need to be prepared to negotiate with buyers on price, terms, and contingencies. This requires a willingness to compromise and a focus on finding mutually beneficial solutions.

Real estate agents are playing a crucial role in helping sellers navigate the changing market. They are providing data-driven insights, offering advice on pricing and staging, and negotiating on behalf of their clients. Agents are also helping buyers find homes that meet their needs and budgets, guiding them through the complexities of the purchasing process.

The long-term outlook for the housing market remains uncertain. While the current imbalance between supply and demand is expected to persist for the foreseeable future, the market will eventually stabilize as buyers and sellers adjust to the new normal. This could involve a period of price corrections, followed by a gradual recovery in sales activity.

The impact of the housing market on the broader economy is also significant. The housing sector is a major driver of economic growth, and a slowdown in the market can have ripple effects throughout the economy. Reduced home sales can lead to lower construction activity, decreased spending on home-related goods and services, and a decline in consumer confidence.

Conversely, a healthy housing market can stimulate economic growth, create jobs, and boost consumer spending. Therefore, it is essential for policymakers to monitor the housing market closely and take steps to support its stability and affordability.

The current housing market imbalance presents both challenges and opportunities for different stakeholders. Sellers need to adapt their strategies to meet the changing market demands, while buyers may find more opportunities to negotiate and find homes that fit their needs and budgets. Real estate agents need to be proactive in providing guidance and support to their clients as they navigate the evolving landscape.

Frequently Asked Questions (FAQ):

-

Why are so many sellers listing their homes right now?

- Sellers are motivated by a combination of factors, including the desire to capitalize on previous price gains, changing lifestyle preferences due to remote work, and anticipation of potential market corrections. Many homeowners who had been contemplating selling for some time are now entering the market to take advantage of the high prices before they potentially decline. “Sellers are flooding the home market,” as the original report states, suggesting a rush to list properties while conditions are still favorable.

-

What is causing the decrease in buyer demand?

- The primary driver behind the buyer pullback is rising mortgage rates. As the Federal Reserve has increased interest rates to combat inflation, mortgage rates have followed suit, making homeownership less affordable. Additionally, economic uncertainty, including concerns about a potential recession and job losses, is making potential buyers hesitant to make large financial commitments.

-

How are rising mortgage rates impacting affordability?

- Higher mortgage rates increase the overall cost of homeownership, making it more difficult for potential buyers to qualify for a mortgage. The increased monthly payments associated with higher rates reduce the amount that buyers can afford to spend on a home, effectively pricing many out of the market. This is especially impactful for first-time homebuyers who may have limited savings and income.

-

Are home prices expected to decline?

- While there is no guarantee of price declines, the increasing inventory and decreased buyer demand suggest that price corrections are possible. Sellers are already beginning to reduce their prices to attract buyers, signaling a potential cooling of the market. The extent of any price declines will depend on various factors, including the severity of the economic slowdown and the pace of mortgage rate increases.

-

What should sellers do in this changing market?

- Sellers need to be more strategic in their approach. This includes pricing their homes competitively, investing in professional staging and photography, and being prepared to negotiate with potential buyers. It is also essential to work with an experienced real estate agent who can provide data-driven insights and guidance. Patience and realistic expectations are crucial for sellers in the current market.

Expanded Context and Background Information:

The current state of the housing market is a complex interplay of economic forces and shifting consumer behaviors. To fully understand the “Housing Market Mayhem,” it’s crucial to delve deeper into the historical context, the underlying economic principles, and the potential long-term implications.

The recent housing boom, fueled by record-low interest rates and a surge in demand during the pandemic, was unprecedented. As people spent more time at home, many sought larger living spaces, driving up demand for single-family homes. Simultaneously, supply chain disruptions and labor shortages hampered new construction, further exacerbating the imbalance between supply and demand. This perfect storm led to bidding wars and rapid price appreciation, creating a market that was highly favorable to sellers.

However, the tide began to turn in early 2022 as the Federal Reserve embarked on a series of interest rate hikes to combat inflation. These rate increases had a direct impact on mortgage rates, which soared to levels not seen in years. The rise in mortgage rates effectively cooled down the housing market, as potential buyers became more cautious and affordability diminished.

The impact of rising mortgage rates is not limited to potential homebuyers. Existing homeowners who are considering refinancing their mortgages are also affected. Higher rates make refinancing less attractive, as the potential savings from a lower interest rate are often outweighed by the costs of refinancing. This can limit homeowners’ ability to access equity in their homes and potentially reduce their disposable income.

The economic uncertainty surrounding the housing market is also contributing to the slowdown in sales activity. Concerns about a potential recession, job losses, and inflation are weighing on consumer sentiment and making potential buyers hesitant to make large financial commitments. The fear of an economic downturn is leading some buyers to delay their purchases, waiting for more clarity and stability in the market.

The regional variations in the housing market are also important to consider. Some areas are experiencing a more pronounced slowdown than others, depending on factors such as local economic conditions, population growth, and housing supply. For example, cities with a high concentration of tech companies have seen a significant decline in home sales as some tech companies have announced layoffs or reduced hiring. Conversely, areas with strong economies and growing populations may be more resilient to the downturn.

The increased inventory is giving buyers more negotiating power, a stark contrast to the bidding wars that characterized the pandemic-era market. With more homes available to choose from, buyers are no longer pressured to make quick decisions or overpay for properties. They can now take their time to evaluate their options, negotiate for better terms, and even request repairs or concessions from sellers. This shift in negotiating power is a significant change from the previous market conditions.

For sellers, the changing market dynamics require a shift in strategy. Pricing is now more critical than ever. Sellers need to be realistic about the value of their homes and price them competitively to attract buyers. Overpricing a property can lead to longer listing times, price reductions, and ultimately a lower sale price. Sellers need to consult with their real estate agent to determine the appropriate pricing strategy for their property.

Marketing and presentation are also essential for success in the current market. Sellers need to showcase their homes in the best possible light, highlighting their unique features and benefits. This includes investing in professional staging and photography, creating compelling marketing materials, and hosting open houses and showings to attract potential buyers. The first impression is crucial, and sellers need to make sure their homes are presented in the best possible way.

Negotiation skills are also becoming increasingly important. Sellers need to be prepared to negotiate with buyers on price, terms, and contingencies. This requires a willingness to compromise and a focus on finding mutually beneficial solutions. Sellers need to be flexible and willing to work with buyers to reach an agreement that satisfies both parties.

Real estate agents are playing a crucial role in helping sellers and buyers navigate the changing market. They are providing data-driven insights, offering advice on pricing and staging, and negotiating on behalf of their clients. Agents are also helping buyers find homes that meet their needs and budgets, guiding them through the complexities of the purchasing process. The expertise of a real estate agent can be invaluable in the current market.

The long-term outlook for the housing market remains uncertain. While the current imbalance between supply and demand is expected to persist for the foreseeable future, the market will eventually stabilize as buyers and sellers adjust to the new normal. This could involve a period of price corrections, followed by a gradual recovery in sales activity. The timing and magnitude of any recovery will depend on various factors, including the pace of economic growth, the path of interest rates, and the level of consumer confidence.

The impact of the housing market on the broader economy is significant. The housing sector is a major driver of economic growth, and a slowdown in the market can have ripple effects throughout the economy. Reduced home sales can lead to lower construction activity, decreased spending on home-related goods and services, and a decline in consumer confidence. Conversely, a healthy housing market can stimulate economic growth, create jobs, and boost consumer spending. Therefore, it is essential for policymakers to monitor the housing market closely and take steps to support its stability and affordability.

The government’s role in the housing market is multifaceted. Policies related to mortgage lending, housing subsidies, and zoning regulations can all have a significant impact on the market. The government can also play a role in promoting affordable housing and preventing foreclosures. The effectiveness of government policies in addressing housing market challenges is a subject of ongoing debate.

The current housing market imbalance presents both challenges and opportunities for different stakeholders. Sellers need to adapt their strategies to meet the changing market demands, while buyers may find more opportunities to negotiate and find homes that fit their needs and budgets. Real estate agents need to be proactive in providing guidance and support to their clients as they navigate the evolving landscape. The key to success in the current market is to be informed, adaptable, and prepared to navigate the challenges and opportunities that arise.

In conclusion, the “Housing Market Mayhem” is a complex phenomenon driven by a confluence of factors. The surge in sellers and the pullback from buyers are creating an imbalance that is reshaping the real estate landscape. Understanding the underlying causes of this imbalance, as well as the potential long-term implications, is crucial for all stakeholders in the housing market. The market is constantly evolving, and it is essential to stay informed and adapt to the changing conditions. The information contained herein is intended for general knowledge and should not be considered financial advice. Consult with a qualified professional before making any investment decisions.