Forget Florida and Arizona; two unexpected states, North Carolina and Idaho, are increasingly attracting retirees with their blend of affordability, natural beauty, and thriving communities.

Retire Where? These 2 Surprising States Are Calling Your Name

As traditional retirement hotspots like Florida and Arizona become increasingly crowded and expensive, many retirees are seeking alternative destinations that offer a high quality of life without breaking the bank. According to recent data and expert analysis, North Carolina and Idaho are emerging as frontrunners, offering a unique combination of affordability, natural beauty, and vibrant communities that appeal to a diverse range of retirees. These states provide a compelling alternative for those looking to stretch their retirement savings while enjoying a fulfilling and active lifestyle.

North Carolina: A Southern Gem with Coastal Charm and Mountain Majesty

North Carolina, with its diverse landscape ranging from the Outer Banks to the Blue Ridge Mountains, presents a compelling case for retirement. The state boasts a moderate climate, making it attractive to those seeking respite from harsh winters.

-

Affordability: Compared to the national average, North Carolina offers a lower cost of living, particularly in housing. While prices in popular areas like Asheville have risen, many smaller towns and rural communities still offer affordable options. The median home price in North Carolina is generally lower than in states like Florida and California, allowing retirees to purchase more property for their money. The state also has relatively reasonable property taxes compared to other states on the East Coast.

-

Healthcare: North Carolina has a robust healthcare system, with numerous hospitals and medical centers throughout the state. Major healthcare providers like Duke Health, UNC Health, and Wake Forest Baptist Health provide access to specialized care and research facilities. This is a significant factor for retirees who prioritize access to quality medical services.

-

Culture and Recreation: North Carolina offers a rich cultural scene, with thriving arts communities, music festivals, and historical sites. The state’s diverse geography provides ample opportunities for outdoor recreation, including hiking, fishing, golfing, and watersports. The Outer Banks offer stunning beaches and coastal activities, while the Blue Ridge Mountains provide scenic hiking trails and breathtaking views. Cities like Asheville and Raleigh have vibrant downtown areas with restaurants, shops, and entertainment venues.

-

Tax Benefits: While North Carolina does not eliminate state income tax on Social Security benefits, it does offer some tax advantages for retirees. The state’s income tax rate is relatively low compared to other states, and there are deductions available for certain types of retirement income.

Idaho: A Rocky Mountain Paradise with Outdoor Adventures and a Low Tax Burden

Idaho, known for its stunning Rocky Mountain scenery and outdoor recreational opportunities, is increasingly gaining attention as a retirement destination. The state offers a unique blend of natural beauty, a low tax burden, and a strong sense of community.

-

Low Taxes: One of Idaho’s most significant advantages for retirees is its low tax burden. The state has no estate or inheritance tax, and property taxes are relatively low compared to other states. Idaho also offers a generous retirement tax subtraction, which can significantly reduce state income taxes for retirees. This makes Idaho an attractive option for those looking to maximize their retirement income.

-

Outdoor Recreation: Idaho is an outdoor enthusiast’s paradise, with opportunities for hiking, fishing, skiing, and whitewater rafting. The state is home to numerous national forests, wilderness areas, and scenic rivers, providing endless opportunities for exploration and adventure. Popular destinations include Yellowstone National Park (accessible from Idaho), Sawtooth National Forest, and Hells Canyon.

-

Growing Economy: Idaho’s economy has been growing rapidly in recent years, driven by the technology sector and other industries. This has led to increased job opportunities and a strong housing market. While this growth has also resulted in higher housing prices in some areas, many smaller towns and rural communities still offer affordable options.

-

Healthcare Access: While Idaho’s healthcare system may not be as extensive as North Carolina’s, the state has made significant investments in healthcare infrastructure in recent years. Major hospital systems like St. Luke’s and Saint Alphonsus provide access to quality medical care throughout the state. The state is also working to expand access to healthcare in rural areas.

Why These States Are Gaining Popularity

The growing popularity of North Carolina and Idaho as retirement destinations can be attributed to several factors:

-

Rising Costs in Traditional Retirement Hotspots: States like Florida and Arizona have seen significant increases in housing costs and property taxes in recent years, making them less affordable for many retirees. This has prompted many to look for alternative destinations that offer a better value for their money.

-

Desire for a More Active Lifestyle: Many retirees are seeking destinations that offer opportunities for outdoor recreation and an active lifestyle. North Carolina and Idaho both provide ample opportunities for hiking, fishing, golfing, and other outdoor activities.

-

Appreciation for Natural Beauty: The stunning natural landscapes of North Carolina and Idaho are a major draw for retirees. From the beaches of the Outer Banks to the mountains of the Rockies, these states offer a diverse range of scenery that appeals to a wide range of tastes.

-

Lower Tax Burden: The low tax burden in Idaho is a significant advantage for retirees, allowing them to keep more of their retirement income. North Carolina also offers some tax advantages, although they are not as significant as those in Idaho.

Expert Opinions and Data

Several financial experts and retirement planning organizations have highlighted North Carolina and Idaho as promising retirement destinations. U.S. News & World Report, for example, consistently ranks both states highly in its annual “Best States to Retire” rankings. These rankings take into account factors such as affordability, healthcare, quality of life, and access to amenities.

“North Carolina offers a blend of Southern charm, natural beauty, and a relatively affordable cost of living, making it an attractive option for retirees,” says a financial advisor at Fidelity Investments. “Idaho, on the other hand, appeals to those who value outdoor recreation and a low tax burden. Both states offer a compelling alternative to the traditional retirement hotspots.”

Data from the U.S. Census Bureau shows that both North Carolina and Idaho have experienced significant population growth in recent years, driven in part by retirees moving to these states. This influx of new residents has contributed to a vibrant and diverse community in both states.

Considerations Before Making the Move

While North Carolina and Idaho offer many advantages for retirees, it is essential to consider all factors before making a move.

-

Climate: North Carolina has a moderate climate with four distinct seasons, while Idaho has a more varied climate with hot summers and cold winters. Retirees should consider their preferences when it comes to weather and seasonal changes.

-

Healthcare Access: While both states have made investments in healthcare infrastructure, access to specialized medical care may be limited in some rural areas. Retirees with specific medical needs should research the availability of healthcare services in their desired location.

-

Job Opportunities: While most retirees are not looking for employment, some may want to work part-time or start a small business. The job market in North Carolina is more diverse than in Idaho, offering a wider range of opportunities.

-

Cultural Amenities: North Carolina has a more established cultural scene than Idaho, with more museums, theaters, and concert venues. Retirees who prioritize cultural amenities may find North Carolina to be a better fit.

-

Housing Costs: While both states offer affordable housing options compared to traditional retirement hotspots, housing prices have been rising in recent years, particularly in popular areas. Retirees should carefully research housing costs in their desired location and consider their budget.

Making the Right Choice

Ultimately, the best retirement destination depends on individual preferences and priorities. North Carolina and Idaho offer compelling alternatives to the traditional retirement hotspots, providing a unique blend of affordability, natural beauty, and vibrant communities. Retirees should carefully consider their needs and preferences before making a move and conduct thorough research to ensure that their chosen destination is the right fit.

In-Depth Analysis: Comparing North Carolina and Idaho

To provide a more comprehensive comparison, let’s delve deeper into specific aspects of North Carolina and Idaho, analyzing their strengths and weaknesses in relation to retirement needs.

Cost of Living:

-

North Carolina: While generally more affordable than the national average, the cost of living in North Carolina varies significantly by region. Coastal areas and cities like Asheville tend to be more expensive than rural communities in the Piedmont or mountains. Housing costs, while lower than in states like California or New York, have been steadily increasing. Property taxes are moderate, but income tax is a factor to consider. Groceries and utilities are generally on par with the national average.

-

Idaho: Idaho boasts a lower overall cost of living than North Carolina, primarily driven by lower housing costs and property taxes in many areas. While Boise and other metropolitan areas have seen a surge in housing prices, smaller towns and rural regions remain relatively affordable. Idaho’s significant advantage lies in its low property taxes and the absence of estate or inheritance taxes. However, groceries and transportation costs might be slightly higher due to the state’s more remote location in some areas.

Healthcare:

-

North Carolina: North Carolina has a well-developed healthcare system with renowned medical centers like Duke University Hospital, UNC Medical Center, and Wake Forest Baptist Medical Center. These institutions offer a wide range of specialized medical services and attract top medical professionals. The state also has a strong network of community hospitals and clinics, ensuring access to healthcare for residents throughout the state. The presence of major pharmaceutical companies and research institutions further strengthens North Carolina’s healthcare landscape.

-

Idaho: While Idaho’s healthcare system is growing, it’s less extensive than North Carolina’s. Major hospital systems like St. Luke’s and Saint Alphonsus provide quality care in urban centers, but access to specialized services might be limited in rural areas. The state is actively working to expand healthcare access and improve health outcomes, but it still faces challenges related to workforce shortages and geographic disparities. Telehealth is becoming increasingly important in bridging the gap in healthcare access for rural residents.

Taxes:

-

North Carolina: North Carolina has a flat income tax rate, which is relatively low compared to many other states. While Social Security benefits are not exempt from state income tax, there are deductions available for other types of retirement income. Property taxes are moderate, and sales taxes are generally in line with the national average.

-

Idaho: Idaho’s tax environment is particularly favorable for retirees. The state has no estate or inheritance tax, and property taxes are among the lowest in the country. Idaho also offers a generous retirement tax subtraction, allowing retirees to significantly reduce their state income tax liability. This tax-friendly environment can make a substantial difference in retirees’ disposable income.

Climate and Geography:

-

North Carolina: North Carolina offers a diverse climate, ranging from subtropical conditions along the coast to temperate conditions in the mountains. Summers are generally warm and humid, while winters are mild. The state’s geography is equally diverse, with beaches, coastal plains, rolling hills, and mountains. This variety allows retirees to choose a location that suits their preferred climate and lifestyle.

-

Idaho: Idaho’s climate is characterized by hot, dry summers and cold, snowy winters. The state’s geography is dominated by the Rocky Mountains, with vast forests, rivers, and lakes. This rugged terrain offers endless opportunities for outdoor recreation, but it also means that some areas are more isolated and experience harsher weather conditions.

Culture and Recreation:

-

North Carolina: North Carolina has a rich cultural heritage, with influences from Southern traditions, Appalachian music, and a growing arts scene. Cities like Asheville, Raleigh, and Durham offer a vibrant mix of restaurants, shops, museums, and entertainment venues. The state is also home to numerous historical sites, including the Biltmore Estate and several Civil War battlefields.

-

Idaho: Idaho’s culture is rooted in its frontier history and its connection to the natural environment. The state is known for its outdoor recreation opportunities, including hiking, fishing, skiing, and whitewater rafting. Cities like Boise and Coeur d’Alene offer a growing arts and culture scene, but the focus is often on outdoor activities and community events.

Community and Lifestyle:

-

North Carolina: North Carolina has a welcoming and friendly atmosphere, with a strong sense of community. The state’s population is diverse, with a mix of long-time residents and newcomers from other parts of the country. There are numerous opportunities to get involved in local organizations, volunteer groups, and social activities.

-

Idaho: Idaho has a strong sense of community, with a focus on independence and self-reliance. The state’s population is less diverse than North Carolina’s, but it is becoming increasingly diverse as more people move to the state. There are numerous opportunities to get involved in outdoor recreation groups, community events, and volunteer organizations.

Making an Informed Decision:

Choosing the right retirement destination is a personal decision that should be based on individual needs and preferences. North Carolina and Idaho offer compelling alternatives to the traditional retirement hotspots, but they also have their own unique strengths and weaknesses. By carefully considering the factors outlined above, retirees can make an informed decision and choose a destination that will provide them with a fulfilling and enjoyable retirement.

The Impact of Remote Work on Retirement Decisions

The rise of remote work has further complicated retirement decisions. With more people able to work from anywhere, the traditional constraints of needing to be near a job have lessened. This opens up even more possibilities for retirement destinations, allowing people to prioritize lifestyle and affordability over proximity to a workplace. This trend is likely contributing to the increased interest in states like North Carolina and Idaho, which offer a desirable quality of life at a relatively lower cost than many major metropolitan areas.

Retirees who are able to continue working remotely, even on a part-time basis, may find that they can stretch their retirement savings even further by moving to a more affordable location. This can be particularly beneficial for those who are retiring earlier than planned or who have not saved as much as they would have liked.

The Role of Financial Planning in Choosing a Retirement Destination

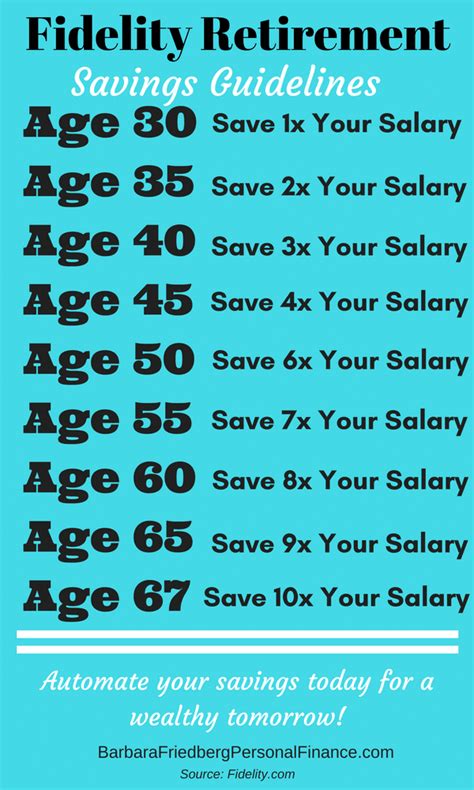

Regardless of where you choose to retire, it’s crucial to have a solid financial plan in place. This plan should take into account your retirement income, expenses, and assets, as well as your goals for retirement. A financial advisor can help you create a personalized plan that will ensure you have enough money to live comfortably throughout your retirement years.

When choosing a retirement destination, it’s important to consider the cost of living, taxes, and healthcare costs in that location. You should also factor in the cost of housing, transportation, and other expenses. A financial advisor can help you estimate these costs and determine whether your retirement income will be sufficient to cover them.

FAQ: Retiring in North Carolina or Idaho

Here are five frequently asked questions about retiring in North Carolina or Idaho:

-

Q: Which state has lower taxes, North Carolina or Idaho? A: Idaho generally has lower taxes than North Carolina, particularly due to the absence of estate or inheritance tax and its generous retirement tax subtraction. North Carolina has a flat income tax rate, but does not exempt Social Security benefits.

-

Q: Which state has better access to healthcare? A: North Carolina has a more developed and extensive healthcare system with renowned medical centers and a strong network of community hospitals and clinics. While Idaho is improving its healthcare infrastructure, access to specialized services may be limited in some rural areas.

-

Q: Which state offers more diverse outdoor recreational opportunities? A: Both states offer ample outdoor recreational opportunities, but they cater to different preferences. North Carolina has beaches, coastal plains, rolling hills, and mountains, while Idaho is dominated by the Rocky Mountains, with vast forests, rivers, and lakes. The choice depends on whether you prefer coastal activities or mountain adventures.

-

Q: What is the weather like in North Carolina and Idaho? A: North Carolina has a moderate climate with four distinct seasons, ranging from subtropical conditions along the coast to temperate conditions in the mountains. Idaho has a more varied climate with hot, dry summers and cold, snowy winters.

-

Q: Which state is more affordable for retirees? A: Idaho is generally more affordable than North Carolina, primarily due to lower housing costs and property taxes in many areas. However, housing costs in some popular areas of Idaho have been rising in recent years, so it’s important to research specific locations.

Conclusion: Weighing the Options for a Fulfilling Retirement

The decision of where to retire is deeply personal, shaped by individual financial situations, lifestyle preferences, and healthcare needs. North Carolina and Idaho present themselves as compelling alternatives to the traditionally popular retirement states, offering unique blends of affordability, natural beauty, and vibrant communities. By thoroughly researching these states, comparing their advantages and disadvantages, and carefully considering their own priorities, prospective retirees can make informed choices that pave the way for a fulfilling and enjoyable retirement. The rise of remote work further expands the possibilities, allowing individuals to prioritize lifestyle and affordability while maintaining their careers. As the landscape of retirement evolves, these often-overlooked states are poised to capture the attention of those seeking a balanced and enriching chapter in their lives.