Are you saving enough for retirement? Financial experts suggest specific savings milestones for individuals in their 30s, 50s, and 60s to ensure a comfortable retirement. These milestones, based on a multiple of your current salary, serve as benchmarks to gauge your preparedness and make necessary adjustments to your savings strategy.

Many Americans face a retirement savings shortfall, raising concerns about their financial security in later life. According to recent data, a significant portion of the population is not on track to meet their retirement goals, underscoring the importance of understanding these milestones and taking proactive steps to improve their savings habits. Understanding these benchmarks can empower individuals to assess their current financial standing, identify potential gaps, and implement strategies to enhance their retirement savings.

Retirement Savings Milestones: A Decade-by-Decade Guide

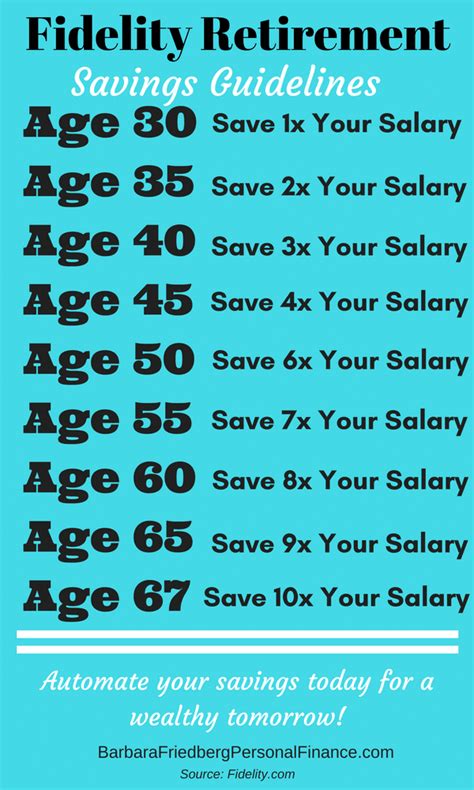

The general rule of thumb is that by age 30, you should have saved the equivalent of one year’s salary. By age 50, this should increase to four times your salary, and by age 60, you should aim for eight times your salary. However, these are just guidelines, and individual circumstances may vary significantly.

“These milestones are not meant to be rigid rules, but rather helpful benchmarks to assess progress,” explains a financial advisor. “Your personal retirement needs will depend on factors such as your desired lifestyle, expected healthcare costs, and any other sources of income you may have.”

Savings Goals by Age:

- Age 30: Aim to have saved at least one year’s salary. If you earn $60,000 annually, your retirement savings should be around $60,000.

- Age 40: Strive to have three times your annual salary saved. Using the same example, this would be $180,000.

- Age 50: Target four times your salary. A $60,000 earner should aim for $240,000.

- Age 60: Reach eight times your annual salary. This would equate to $480,000 for someone earning $60,000 per year.

- Age 67 (Full Retirement Age): Ideally, have ten times your final salary saved to ensure a comfortable retirement. This amounts to $600,000 for the $60,000 earner.

Factors Influencing Retirement Savings Needs:

Several factors influence how much you need to save for retirement. These include:

- Desired Lifestyle: A more lavish lifestyle requires significantly more savings.

- Healthcare Costs: Healthcare expenses tend to increase with age.

- Other Income Sources: Pensions, Social Security, and part-time work can supplement retirement savings.

- Inflation: Inflation erodes the purchasing power of savings over time.

- Investment Returns: Investment returns can significantly impact the growth of your retirement savings.

- Debt: Outstanding debts can reduce the amount available for savings.

- Retirement Age: Retiring earlier requires more savings.

- Life Expectancy: Longer life expectancy means needing more savings to cover expenses.

Strategies to Improve Retirement Savings:

If you’re not on track to meet the savings milestones, there are several steps you can take to improve your situation:

- Increase Contributions: Even small increases in contributions can make a big difference over time.

- Take Advantage of Employer Matching: Contribute enough to your 401(k) to receive the full employer match.

- Reduce Expenses: Identify areas where you can cut back on spending and allocate those savings to retirement.

- Delay Retirement: Working a few extra years can significantly boost your retirement savings.

- Seek Professional Advice: A financial advisor can help you create a personalized retirement plan.

- Consistently Re-evaluate: Regularly assess your progress and adjust your strategy as needed.

- Invest Wisely: Diversify your investments to manage risk and maximize returns.

- Catch-Up Contributions: If you are age 50 or older, take advantage of catch-up contributions to boost your savings.

The Impact of Inflation on Retirement Savings

Inflation is a key consideration when planning for retirement. It erodes the purchasing power of your savings, meaning that the same amount of money will buy less in the future. To combat the effects of inflation, it is crucial to factor it into your retirement calculations and invest in assets that have the potential to outpace inflation, such as stocks or real estate.

“Inflation can significantly impact the real value of your retirement savings,” warns an economist. “It’s essential to consider inflation when estimating your future expenses and adjusting your savings goals accordingly.”

The Role of Social Security

Social Security benefits can provide a valuable source of income during retirement, but they are typically not enough to cover all expenses. It is essential to understand how Social Security works and how much you can expect to receive in benefits. You can estimate your future benefits by using the Social Security Administration’s online calculator.

“Social Security is an important part of the retirement puzzle, but it shouldn’t be relied upon as the sole source of income,” advises a retirement planner. “It’s crucial to supplement Social Security with your own savings and investments.”

The Importance of Early Savings

Starting to save for retirement early in your career can make a significant difference in the long run. The power of compounding allows your investments to grow exponentially over time. Even small contributions made early on can accumulate into a substantial sum by the time you retire.

“The earlier you start saving, the less you need to save each month to reach your retirement goals,” explains a financial advisor. “Time is your greatest asset when it comes to retirement savings.”

Common Retirement Savings Mistakes:

Many people make common mistakes that can derail their retirement savings plans. These include:

- Procrastinating: Delaying saving for retirement until later in life.

- Withdrawing Early: Withdrawing funds from retirement accounts before retirement.

- Not Diversifying: Investing in only one type of asset.

- Ignoring Fees: Paying excessive fees for investment management.

- Underestimating Expenses: Underestimating how much money they will need in retirement.

- Failing to Adjust: Not adjusting their savings plan as their circumstances change.

- Being Too Conservative: Investing too conservatively and missing out on potential growth.

Retirement Planning for Self-Employed Individuals:

Self-employed individuals face unique challenges when it comes to retirement savings. They do not have access to employer-sponsored retirement plans like 401(k)s and must take the initiative to set up their own retirement accounts. Options for self-employed individuals include SEP IRAs, SIMPLE IRAs, and Solo 401(k)s.

“Self-employed individuals need to be proactive about retirement savings,” advises a financial advisor. “They should explore the various retirement plan options available to them and choose the one that best suits their needs.”

Strategies for Maximizing 401(k) Contributions

Maximizing your 401(k) contributions is one of the most effective ways to build a substantial retirement nest egg. Take advantage of employer matching, increase your contribution percentage gradually over time, and consider contributing the maximum amount allowed each year.

“The 401(k) is a powerful tool for retirement savings,” says a retirement specialist. “By maximizing your contributions and taking advantage of employer matching, you can significantly boost your retirement savings.”

The Impact of Debt on Retirement Savings

High levels of debt can significantly impact your ability to save for retirement. Interest payments on debt can eat into your savings and reduce the amount of money available for retirement contributions. Prioritize paying off high-interest debt, such as credit card debt, before focusing on retirement savings.

“Debt can be a major obstacle to retirement savings,” warns a financial advisor. “It’s important to manage your debt effectively and prioritize paying it down as quickly as possible.”

Retirement Planning for Women

Women often face unique challenges when it comes to retirement savings. They tend to live longer than men, which means they need to save more to cover their longer retirement. They may also experience career interruptions due to childcare or caregiving responsibilities, which can impact their earning potential and retirement savings.

“Women need to be particularly diligent about retirement planning,” advises a financial advisor. “They should focus on maximizing their savings, investing wisely, and planning for a potentially longer retirement.”

The Importance of Estate Planning

Estate planning is an essential part of retirement planning. It involves creating a plan for how your assets will be distributed after your death. A well-crafted estate plan can help ensure that your loved ones are taken care of and that your assets are distributed according to your wishes.

“Estate planning is an important part of ensuring your financial legacy,” says an estate planning attorney. “It’s important to work with an experienced attorney to create a plan that meets your needs and protects your loved ones.”

Navigating Market Volatility

Market volatility can be unsettling for investors, especially those nearing retirement. It is important to stay calm and avoid making impulsive decisions based on short-term market fluctuations. Maintain a diversified portfolio and focus on your long-term investment goals.

“Market volatility is a normal part of investing,” says a financial advisor. “It’s important to stay disciplined and avoid making emotional decisions that could harm your long-term investment returns.”

The Role of a Financial Advisor

A financial advisor can provide valuable guidance and support in planning for retirement. They can help you assess your financial situation, set realistic goals, create a personalized retirement plan, and manage your investments.

“A financial advisor can be a valuable partner in your retirement planning journey,” says a retirement planner. “They can provide expert advice and help you stay on track to meet your retirement goals.”

Understanding Investment Options

There are numerous investment options available for retirement savings, each with its own risks and potential rewards. Common investment options include stocks, bonds, mutual funds, and exchange-traded funds (ETFs). It is important to understand the different investment options and choose those that align with your risk tolerance and investment goals.

“Understanding your investment options is crucial for building a successful retirement portfolio,” says an investment advisor. “It’s important to diversify your investments and choose those that are appropriate for your individual circumstances.”

Tax-Advantaged Retirement Accounts

Tax-advantaged retirement accounts, such as 401(k)s and IRAs, offer significant tax benefits that can help you save more for retirement. Contributions to these accounts may be tax-deductible, and earnings grow tax-deferred until retirement.

“Tax-advantaged retirement accounts are a powerful tool for retirement savings,” says a tax advisor. “By taking advantage of these accounts, you can significantly reduce your tax burden and save more for retirement.”

Creating a Retirement Budget

Creating a retirement budget is an essential step in planning for retirement. It involves estimating your expenses in retirement and determining how much income you will need to cover those expenses. A retirement budget can help you identify potential gaps in your savings and make necessary adjustments to your retirement plan.

“Creating a retirement budget is essential for understanding your financial needs in retirement,” says a financial planner. “It can help you identify potential gaps in your savings and make necessary adjustments to your retirement plan.”

Staying Informed About Retirement Planning

Retirement planning is an ongoing process. It is important to stay informed about changes in the retirement landscape, such as changes to Social Security, tax laws, and investment options. Regularly review your retirement plan and make adjustments as needed to ensure that you stay on track to meet your goals.

“Retirement planning is an ongoing process,” says a retirement specialist. “It’s important to stay informed and make adjustments to your plan as needed to ensure that you stay on track to meet your goals.”

The Psychological Aspects of Retirement Planning

Retirement planning is not just about numbers; it also involves psychological aspects. Many people struggle with the transition to retirement and may experience feelings of anxiety, uncertainty, or even boredom. It is important to prepare for the psychological aspects of retirement and to develop a plan for how you will spend your time and stay engaged in life.

“Retirement is a major life transition that can have a significant impact on your emotional well-being,” says a retirement coach. “It’s important to prepare for the psychological aspects of retirement and to develop a plan for how you will spend your time and stay engaged in life.”

Frequently Asked Questions (FAQ) about Retirement Savings:

Q1: How much should I have saved for retirement by age 30?

A: A general guideline suggests having saved at least one year’s salary by age 30. If you earn $60,000 annually, you should aim to have approximately $60,000 in retirement savings. This serves as a foundational benchmark for future savings progress.

Q2: What if I’m behind on my retirement savings goals?

A: If you are behind, don’t panic. Immediately assess your financial situation, increase your contributions to retirement accounts, reduce expenses where possible, and consider seeking professional financial advice. Explore options like catch-up contributions if you’re over 50, and consider delaying retirement if feasible. Even small adjustments can make a significant difference over time.

Q3: How does inflation impact my retirement savings?

A: Inflation erodes the purchasing power of your savings, meaning you’ll need more money to maintain the same standard of living in the future. It’s crucial to factor inflation into your retirement calculations and consider investing in assets that have the potential to outpace inflation, such as stocks or real estate. Regularly review and adjust your savings goals to account for inflation’s impact.

Q4: What are the best investment options for retirement savings?

A: The best investment options depend on your risk tolerance, time horizon, and financial goals. Generally, a diversified portfolio that includes a mix of stocks, bonds, and other assets is recommended. Stocks offer higher potential returns but also carry more risk, while bonds are generally more conservative. Consult with a financial advisor to determine the optimal asset allocation for your individual circumstances.

Q5: How can I maximize my 401(k) contributions?

A: To maximize your 401(k) contributions, contribute enough to receive the full employer match, increase your contribution percentage gradually over time, and consider contributing the maximum amount allowed each year. In 2023, the maximum employee contribution to a 401(k) is $22,500, with an additional $7,500 catch-up contribution allowed for those age 50 and older. Take advantage of these limits to accelerate your retirement savings.

Conclusion:

Planning for retirement is a critical aspect of financial well-being. By understanding the savings milestones for different age groups and taking proactive steps to improve your savings habits, you can increase your chances of achieving a comfortable and secure retirement. It is essential to regularly review your progress, adjust your strategy as needed, and seek professional advice to ensure that you stay on track to meet your retirement goals. While achieving the recommended milestones is important, focusing on consistent savings habits and making informed financial decisions can significantly improve your long-term financial security.