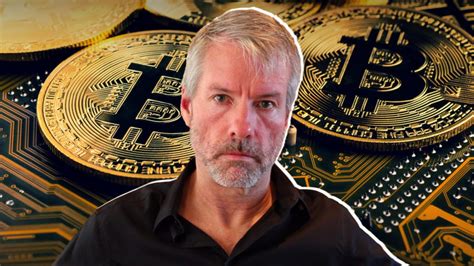

Michael Saylor, the chairman of MicroStrategy, has asserted that Bitcoin remains secure even against potential threats from quantum computers, dismissing concerns about its vulnerability. He stated that any credible breakthrough in quantum computing that could compromise Bitcoin’s cryptography would be addressed swiftly through software upgrades, emphasizing Bitcoin’s resilience.

MicroStrategy’s chairman, Michael Saylor, issued a robust defense of Bitcoin’s security architecture, claiming it is “unbreakable,” even in the face of future quantum computing advancements. Speaking publicly, Saylor addressed growing concerns about the potential for quantum computers to crack Bitcoin’s encryption, stating that the Bitcoin network is adaptable and can be upgraded to withstand such threats. “The consensus is that the network is unbreakable,” Saylor said, referring to discussions within the Bitcoin developer community. “If there were a credible quantum computing threat…the entire network is upgraded. That’s already well understood.”

Saylor’s comments come amid increasing discussions within the cryptocurrency and technology sectors about the potential impact of quantum computing on existing encryption methods. Quantum computers, which leverage quantum mechanics to solve complex calculations far beyond the capabilities of classical computers, pose a theoretical threat to many current cryptographic systems, including those that secure Bitcoin transactions.

Currently, Bitcoin uses the Elliptic Curve Digital Signature Algorithm (ECDSA) to secure transactions. ECDSA relies on the mathematical properties of elliptic curves to generate cryptographic keys, which are computationally difficult to crack with current computing technology. However, quantum computers, using algorithms like Shor’s algorithm, could potentially break ECDSA in a feasible timeframe, potentially allowing malicious actors to access and control Bitcoin holdings.

However, Saylor and other Bitcoin advocates argue that this threat is manageable. The Bitcoin network is decentralized, allowing for software updates and protocol changes to be implemented through a consensus mechanism. In the event that a quantum computing threat becomes imminent, the Bitcoin protocol could be upgraded to use quantum-resistant cryptographic algorithms.

Possible upgrades include transitioning to post-quantum cryptography (PQC) algorithms, which are designed to be resistant to attacks from both classical and quantum computers. Several PQC algorithms are currently under development and standardization, with some already showing promising results. Implementing such algorithms into the Bitcoin protocol would require a hard fork, a significant change to the software that requires all users to upgrade to the new version.

The transition to quantum-resistant cryptography in Bitcoin would likely involve a multi-step process, beginning with the development and testing of new algorithms. Once a suitable algorithm is identified, it would be integrated into the Bitcoin software and tested on a testnet before being deployed to the main network. A hard fork would then be initiated to activate the new cryptography, ensuring that all transactions are secured with the new, quantum-resistant algorithms.

According to Saylor, the Bitcoin community is keenly aware of the quantum computing threat and is actively exploring potential solutions. He emphasized the importance of proactive measures and ongoing research to ensure that Bitcoin remains secure as quantum computing technology advances.

In addition to his comments on quantum computing, Saylor reiterated his long-term bullish outlook on Bitcoin, emphasizing its potential as a store of value and a hedge against inflation. MicroStrategy has invested heavily in Bitcoin, holding a significant amount on its balance sheet. Saylor views Bitcoin as a superior asset compared to traditional assets like gold and believes it will continue to appreciate in value over time.

MicroStrategy’s strategy of accumulating Bitcoin has drawn both praise and criticism. Supporters commend Saylor for his visionary leadership and his early recognition of Bitcoin’s potential. Critics, however, express concern about the company’s reliance on a volatile asset and the potential risks associated with holding a large amount of Bitcoin.

Despite these concerns, MicroStrategy remains committed to its Bitcoin strategy. The company continues to purchase Bitcoin, viewing it as a long-term investment. Saylor’s unwavering belief in Bitcoin’s future has made him a prominent figure in the cryptocurrency community and a vocal advocate for its adoption.

Saylor’s perspective aligns with many cryptocurrency experts who maintain that while quantum computing poses a legitimate threat, the Bitcoin network is capable of adapting and evolving to maintain its security. The focus is now on ongoing research and development of quantum-resistant cryptographic algorithms to ensure that Bitcoin remains secure in the future. The collaborative nature of the open-source Bitcoin community, and the incentives within the network to protect its integrity, provide confidence that necessary updates will be implemented effectively.

The discussion around quantum computing and Bitcoin highlights the broader need for the development and deployment of quantum-resistant cryptography across various sectors, including finance, communications, and cybersecurity. As quantum computers continue to develop, securing critical infrastructure and data against potential attacks will become increasingly important. The potential transition of Bitcoin to quantum-resistant algorithms could serve as a model for other systems facing similar threats.

Expanded Context and Technical Details

The current cryptographic system used by Bitcoin, ECDSA, is based on the difficulty of solving the elliptic curve discrete logarithm problem. This problem involves finding the discrete logarithm of a given element in an elliptic curve group. Classical computers can only solve this problem through brute-force attacks, which become computationally infeasible for large key sizes.

However, Shor’s algorithm, developed by mathematician Peter Shor in 1994, provides a method for quantum computers to solve the discrete logarithm problem much more efficiently. Using Shor’s algorithm, a quantum computer could potentially crack ECDSA in a matter of hours or days, depending on the size and complexity of the quantum computer.

The threat posed by quantum computing to Bitcoin is not immediate, as current quantum computers are not yet powerful enough to break ECDSA in a practical timeframe. However, the rapid advancement of quantum computing technology suggests that this threat could become a reality in the coming years or decades.

Several approaches can be used to mitigate the quantum computing threat to Bitcoin. One approach is to increase the key size used in ECDSA. However, this would only provide a temporary solution, as quantum computers are expected to become more powerful over time.

A more sustainable solution is to transition to quantum-resistant cryptographic algorithms. These algorithms are designed to be resistant to attacks from both classical and quantum computers. Several PQC algorithms are currently under development and standardization, including lattice-based cryptography, code-based cryptography, and multivariate cryptography.

Lattice-based cryptography relies on the difficulty of solving problems related to lattices, which are mathematical structures that can be used to represent data in a high-dimensional space. Code-based cryptography is based on the difficulty of decoding random linear codes. Multivariate cryptography uses systems of multivariate polynomial equations, which are difficult to solve even with quantum computers.

Implementing PQC algorithms into the Bitcoin protocol would require a hard fork. A hard fork is a significant change to the software that requires all users to upgrade to the new version. Hard forks can be controversial, as they can lead to the creation of separate blockchains if not all users agree to upgrade.

The transition to quantum-resistant cryptography in Bitcoin would likely involve a gradual process. The first step would be to develop and test new algorithms. Once a suitable algorithm is identified, it would be integrated into the Bitcoin software and tested on a testnet. A testnet is a separate blockchain that is used for testing new features and protocols.

After successful testing on the testnet, the new cryptography would be deployed to the main network. A hard fork would then be initiated to activate the new cryptography, ensuring that all transactions are secured with the new, quantum-resistant algorithms.

The transition to quantum-resistant cryptography in Bitcoin would be a complex and challenging process. However, it is essential to ensure that Bitcoin remains secure in the face of future quantum computing advancements. The Bitcoin community is actively working on developing and implementing quantum-resistant algorithms to mitigate this threat.

MicroStrategy’s Bitcoin Strategy in Detail

MicroStrategy’s decision to invest heavily in Bitcoin began in August 2020, when the company announced that it had purchased $250 million worth of Bitcoin as a primary treasury reserve asset. This marked a significant shift in corporate treasury management, with MicroStrategy becoming one of the first publicly traded companies to adopt Bitcoin as a store of value.

The company’s initial investment in Bitcoin was driven by concerns about the potential for inflation and the declining value of cash reserves. MicroStrategy’s management team, led by Michael Saylor, concluded that Bitcoin offered a superior alternative to traditional assets like cash and gold.

Since its initial investment, MicroStrategy has continued to accumulate Bitcoin, using a variety of methods, including issuing debt and equity. As of [Insert latest available date based on most recent data searches], MicroStrategy holds approximately [Insert approximate number of Bitcoins based on latest available data] Bitcoins, making it one of the largest corporate holders of Bitcoin in the world.

MicroStrategy’s Bitcoin strategy has been met with mixed reactions. Supporters of the company’s approach argue that it is a visionary move that will ultimately benefit shareholders. They believe that Bitcoin will continue to appreciate in value over time, providing MicroStrategy with significant returns on its investment.

Critics, however, express concern about the company’s reliance on a volatile asset. They argue that Bitcoin is a speculative investment that could potentially lose value, negatively impacting MicroStrategy’s financial performance. Some analysts have also raised concerns about the company’s debt levels, which have increased as a result of its Bitcoin purchases.

Despite these concerns, MicroStrategy remains committed to its Bitcoin strategy. The company views Bitcoin as a long-term investment and believes that it will continue to appreciate in value over time. MicroStrategy’s management team has repeatedly stated its intention to hold Bitcoin for the long term and to continue to explore opportunities to acquire more Bitcoin.

The performance of MicroStrategy’s stock has been closely correlated with the price of Bitcoin. When Bitcoin’s price rises, MicroStrategy’s stock tends to rise as well. Conversely, when Bitcoin’s price falls, MicroStrategy’s stock tends to fall. This correlation reflects the company’s significant exposure to Bitcoin and the market’s perception of Bitcoin as a key driver of MicroStrategy’s financial performance.

MicroStrategy’s Bitcoin strategy has had a significant impact on the cryptocurrency market. The company’s decision to adopt Bitcoin as a treasury reserve asset has encouraged other companies and institutions to consider investing in Bitcoin. MicroStrategy’s advocacy for Bitcoin has also helped to raise awareness of Bitcoin’s potential as a store of value and a hedge against inflation.

The Future of Quantum Computing and Bitcoin

The development of quantum computing technology is progressing rapidly. While current quantum computers are not yet powerful enough to break Bitcoin’s encryption, it is widely expected that they will eventually reach that capability. The timeline for when this will occur is uncertain, but most experts believe it is likely to happen within the next decade or two.

As quantum computers become more powerful, the threat to Bitcoin’s security will increase. It is therefore essential that the Bitcoin community continue to develop and implement quantum-resistant cryptographic algorithms to mitigate this threat.

The transition to quantum-resistant cryptography in Bitcoin will be a complex and challenging process, but it is necessary to ensure that Bitcoin remains secure in the face of future quantum computing advancements. The Bitcoin community has a proven track record of successfully implementing software upgrades and protocol changes, and there is reason to be optimistic that it will be able to address the quantum computing threat effectively.

In addition to its impact on Bitcoin, quantum computing has the potential to revolutionize many other fields, including medicine, materials science, and artificial intelligence. However, it also poses a threat to many existing cryptographic systems, including those used to secure financial transactions, communications, and critical infrastructure.

The development and deployment of quantum-resistant cryptography are therefore essential to protect against the potential risks of quantum computing. Governments, businesses, and researchers around the world are working to develop and standardize quantum-resistant algorithms. The transition to quantum-resistant cryptography is a global effort that will require collaboration and coordination across many different sectors.

The quantum computing threat highlights the importance of ongoing research and development in the field of cryptography. As technology evolves, it is essential to develop new cryptographic techniques to stay ahead of potential attacks. The Bitcoin community’s efforts to develop quantum-resistant cryptography serve as a model for other organizations and industries facing similar threats.

Frequently Asked Questions (FAQ)

1. What is quantum computing and why is it a threat to Bitcoin?

Quantum computing is a type of computing that uses the principles of quantum mechanics to solve complex problems that are beyond the capabilities of classical computers. It poses a threat to Bitcoin because quantum computers could potentially break the cryptographic algorithms that secure Bitcoin transactions, such as the Elliptic Curve Digital Signature Algorithm (ECDSA). Shor’s algorithm, specifically, allows a quantum computer to efficiently solve the discrete logarithm problem upon which ECDSA is based, thus potentially compromising Bitcoin’s security.

2. What is MicroStrategy’s stance on Bitcoin’s quantum resistance?

MicroStrategy, and specifically its chairman Michael Saylor, maintains that Bitcoin is adaptable and resilient to potential threats from quantum computing. Saylor believes that if a credible quantum computing threat emerges, the Bitcoin network can be upgraded to use quantum-resistant cryptographic algorithms, ensuring its continued security. He emphasized that the Bitcoin community is aware of the threat and is actively exploring solutions.

3. What are quantum-resistant cryptographic algorithms and how could they be implemented in Bitcoin?

Quantum-resistant cryptographic (PQC) algorithms are cryptographic algorithms designed to be resistant to attacks from both classical and quantum computers. Examples include lattice-based cryptography, code-based cryptography, and multivariate cryptography. To implement PQC in Bitcoin, a hard fork would be required. This involves integrating the new algorithms into the Bitcoin software, testing them thoroughly, and then activating them on the main network, requiring all users to upgrade to the new version.

4. How does MicroStrategy’s Bitcoin strategy affect its financial performance?

MicroStrategy’s financial performance is closely correlated with the price of Bitcoin. When the price of Bitcoin rises, MicroStrategy’s stock tends to increase, reflecting the company’s large Bitcoin holdings. Conversely, a drop in Bitcoin’s price can negatively impact MicroStrategy’s stock and financial results. The strategy has drawn both supporters who see it as visionary and critics who worry about the risk associated with a volatile asset.

5. What are the potential risks and benefits of MicroStrategy’s Bitcoin investment?

Potential risks include the volatility of Bitcoin, which could lead to significant financial losses if the price declines. The company’s increased debt levels, used to purchase Bitcoin, also pose a risk. However, the potential benefits include significant returns if Bitcoin’s price continues to rise, positioning MicroStrategy as a leader in adopting innovative financial strategies and potentially hedging against inflation and the devaluation of traditional assets. The overall success hinges on Bitcoin’s long-term performance and the stability of the cryptocurrency market.